Foreclosure

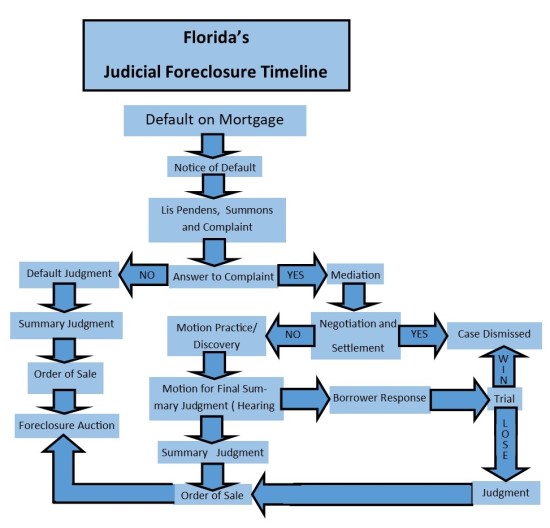

In Florida, a judicial foreclosure state, the process begins when a lender’s attorney files a notice of intent to foreclose with the court. This is followed by the filing of a Lis Pendens, or lawsuit. Once the Summons is issued and served, the homeowner has 20 days to respond. Failure to address the foreclosure can lead to a Notice of Sale and eventual repossession of the property. Given Florida’s judicial foreclosure system, engaging a foreclosure defense attorney may be beneficial.

Lis Pendens

A Lis Pendens is a legal notice indicating a foreclosure lawsuit against a borrower who has defaulted on their mortgage. This status typically occurs around 120 days of missed payments. The Summons demands a court appearance, with usually 20 calendar days to file a response.

Motion for Final Summary Judgment

If the foreclosure is not resolved, you will receive a Final Summary Judgment detailing the fees associated with the foreclosure. The lender will then file a monetary judgment and proceed with asset recovery.

Notice of Sale

A Notice of Sale sets the date for your property’s online auction to the highest bidder, allowing the lender to recover losses or reclaim the property.

The Importance of a Strategic Plan

Addressing foreclosure early is crucial. The longer you wait, the more interest, late fees, and foreclosure charges accrue, making it harder to resolve the situation. Dina’s goal is to help you navigate the foreclosure process, explore your options, and find the best course of action to prevent damage to your credit.

With 25 years in the industry, Dina offers deep expertise in finding effective solutions for your property issues. One potential option is a short sale, particularly if you owe more than your property’s worth. Here are some FAQs about short sales:

FAQs Regarding Short Sales

“I’ve Received a Summons and Complaint – Is it Too Late to Start a Short Sale?” No, it’s not too late. You can still list your property, receive offers, and submit the necessary paperwork to start the short sale process. Many banks will delay foreclosure while processing a short sale offer, so acting quickly is essential.

“Why Choose a Short Sale?” A short sale is a viable option if you cannot afford your mortgage and need to sell your property for less than you owe. It’s an alternative to foreclosure and doesn’t require you to cover costs or fees, as these are handled by the lender. Additionally, a short sale has a less severe impact on your credit score compared to foreclosure.

“How Do I Begin the Short Sale Process?” Find a real estate professional experienced in short sales. You’ll need to sign a 3rd Party Authorization to allow them to communicate with your bank. Prepare your home for sale and gather the necessary documentation. Once an offer is received, it will complete the required paperwork for your lender. A good agent will ensure the offer is strong, the paperwork is complete, and will follow up regularly with your lender.

“Do I Have to Be Behind on Payments for a Short Sale?” Most banks require you to be behind on payments or show imminent default due to financial hardship. While keeping up with payments is beneficial for future borrowing, proving a hardship is easier if you are behind.

“How Long Will a Short Sale Take?” Short sale timelines vary. Factors include the number of loans, response times, and the strength of the offer. Generally, the process can take from 30 days to 12 months.

“Can I Stay in My Home During the Short Sale Process?” Yes, typically you can remain in your home. It’s crucial to keep up with HOA and utility bills to avoid liens, which can delay or hinder the transaction.

“What Does My Lender Require to Initiate a Short Sale?” Common requirements include:

- Hardship letter

- Last 2 years of tax returns

- Most recent bank statements

- Most recent paycheck stubs

- Financial worksheet

- Profit & Loss statement (if self-employed)

“What Is Considered a Hardship?” Hardships can be financial or personal, such as relocation, medical issues, divorce, or other circumstances. Lenders recognize these as valid reasons.

“What If My Short Sale Is Not Approved?” Lenders prefer to avoid foreclosures. If your short sale is denied, work with your agent to explore other options, such as a deed in lieu of foreclosure.

For personalized advice and a thorough analysis of your situation, please call or email us today.

Want to Know How Much Your Home is Worth?

Get Your FREE Home Market Analysis.